Sterling Metals Announces Exploration Update

Extension of High-Grade Mineralization Trend by 200 Metres North of Existing Heimdall North Zone at Sail Pond

November 15, 2023 – Toronto, Ontario – Sterling Metals Corp. (TSXV: SAG, OTCQB: SAGGF) (“Sterling Metals” or the “Company”) is pleased to report assay results from its 2023 drilling on the Sail Pond Silver and Base Metal Project (“Sail Pond”) in the Great Northern Peninsula of Newfoundland. Despite drilling not being able to identify a potential economic trap of high grade sulphides via the 3D Orion survey, using structural interpretations the Company intersected additional high-grade silver-copper mineralization, expanding the Heimdall trend by 200 m (Figure 1).

Key 2023 Exploration Highlights at Sail Pond:

- A total of 8 drill holes covering 2,058 m were completed, focusing on 4 distinct target areas defined by the Orion 3D geophysical survey (the “Orion survey”)

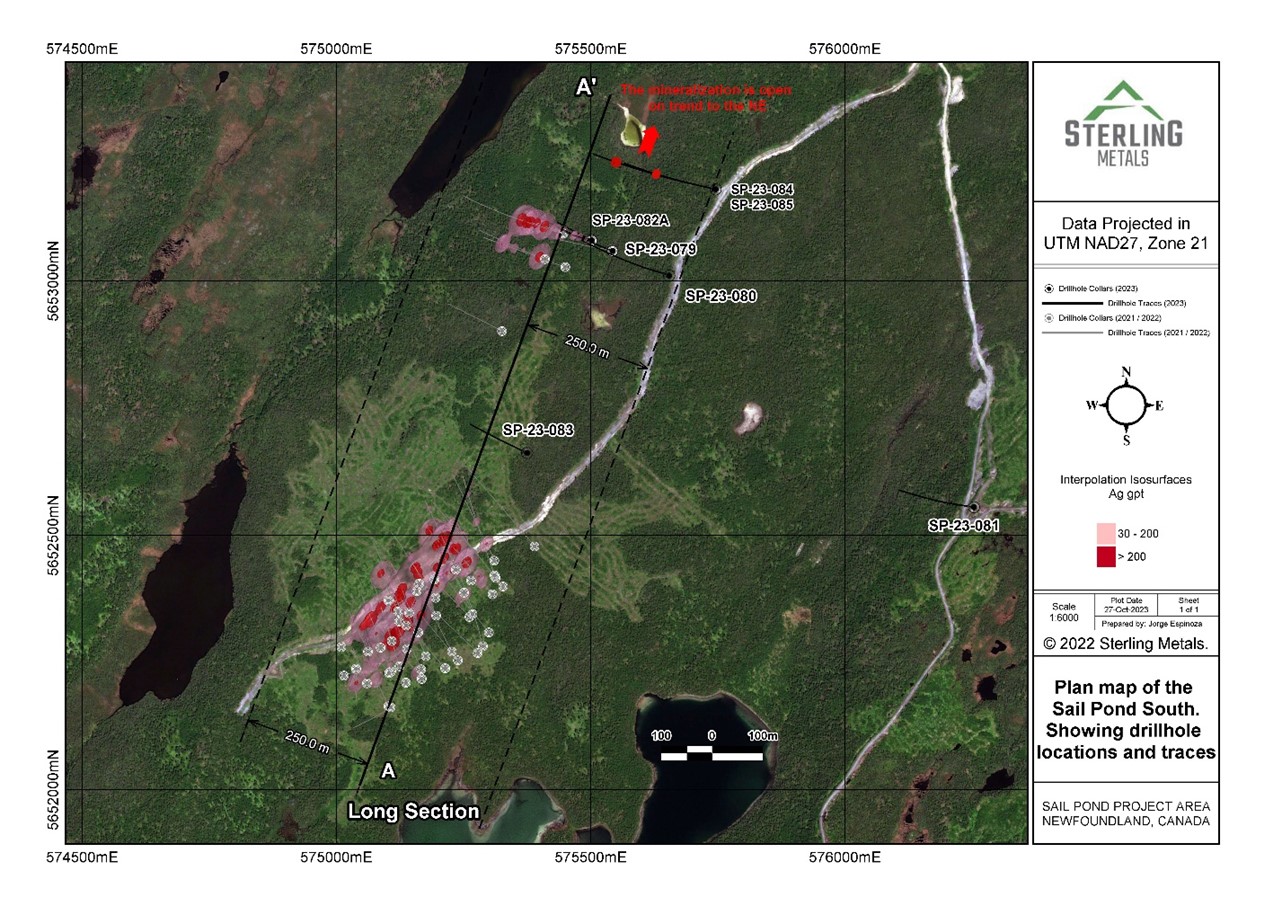

- Drilling extended high-grade silver-copper mineralization 200 m beyond previous intersections (Figure 2) and the area remains open to the north

- The new extension of the Heimdall North Zone discovered through structural interpretation of the project lidar, graded 932 g/t Ag, 4.51% Cu over 0.3 m starting at 209 m depth in hole SP-23-085 (Figure 3) and 303 g/t Ag, 1.26% Cu and 5.59% Pb over 0.3 m starting at 279.9 m (Figure 4)

- The Company is currently undertaking physical property studies using the relevant core from Sail Pond and its new structural understanding to delineate areas of interest for higher permeability where economic quantities of high-grade sulfides are trapped

Jeremy Niemi, SVP Exploration and Evaluation, stated, "Ahead of our 2023 drilling campaign at Sail Pond, we implemented a systematic approach targeting the source of the mineralization at Heimdall North by employing the deep looking Orion survey. We were encouraged by strong geophysical targets in the right geological locations and these targets are where we started our 2023 drilling. Learning from the initial holes and with the mineralization source eluding us, our team rapidly pivoted to focus on structural data and on-the-ground observations for the final holes of the program. The final two holes yielded an additional high-grade copper-silver intersection and a broad mineralization zone spanning nearly 30 meters north of the Heimdall North Zone. Notably, this zone remains open to the north. Moving forward, our efforts will continue to concentrate on locating large areas of interest with the potential for massive sulphide accumulations, aiming to uncover the origins of the numerous high-grade intersections at Sail Pond.”

2023 Exploration Results

During the winter of 2023 Sterling initiated a comprehensive ground geophysical survey in the vicinity of the Heimdall and Heimdall North zones. The primary objective was to detect economic orebody sized anomalies suggesting a potential trap (or pod) of the widespread high-grade silver-copper mineralization. With the deep-looking Orion survey and resistivity technology, multiple target zones were identified, out of which four were prioritized for drilling. The geophysical survey was centered on the Heimdall and Heimdall North zones, covering 39.2-line km of IP to pinpoint mineralization targets, complemented by 19.6km of Titan MT to map crucial structures and lithologies hosting the mineralization. Of particular interest was the high chargeable plume beneath the discovery intersection at Heimdall North, which is down dip from the mineralization and the interpreted location for the source of the mineralization (Figure 1).

Figure 1. Target one of four from the 2023 Orion Survey at line 5600N showing a large anomaly below hole 64 at the Heimdall North Zone

During the drilling at Heimdall North, a significant fault was encountered over the last 4 metres of hole 79 which was the first hole drilled into this plume. The fault contained sand and loose fault gauge which prevented the completion of the hole. It is now thought that large fault, and especially the gauge in the wide fault, which undercuts the mineralization at Heimdall North is potentially contributing to the chargeability response beneath the zone and not an accumulation of sulfides.

The second target focused on an area to the south between Heimdall and the Heimdall North gap (see Figure 2 for plan map), to the site of another chargeability target in line with the trend from the Heimdall zone. Hole SP-23-83 which intersected pyrite bearing argillite in the vicinity of the target suggesting the next anomaly was argillite and not a sulfide trap. The balance of the chargeability anomalies has been explained largely by pyrite in argillite horizons, which are typically adjacent to the common style of mineralization being sulphides and sulphosalts in dolostone.

The final two holes of the program were based on a structural interpretation of surface mapping and detailed LiDAR survey data. Holes SP-23-84/85 targeted structural convergence and what appeared to be a dilation zone which could host additional mineralization 200m north of hole 64 and 600m north of the Heimdall Zone. Both holes intersected high-grade silver-copper mineralization (see figure 3 and 4). This structural corridor, in particular dilation zones along it, will be part of the focus of future work at Sail Pond as we continue to work towards identifying the source of the widespread near surface mineralization.

Adeline Project Update

The Company has completed its 2023 field work program at its Adeline Project in Labrador. A total of 1,930m was drilled, and the Company is currently waiting on assays from ALS. Due to the nature of some of the mineralization extra steps were taken to ensure full collection of copper, which has delayed the timeline for assays. The expectation is that all assays will be complete near the end of the month.

Mathew Wilson, CEO of Sterling states, “Although the outcome from our recent drilling at Sail Pond didn’t align with our expectations following the Orion survey, we are encouraged by the broader structural targeting that led to additional high grade yet narrow intercepts. We are actively evaluating the implications of this on our understanding of the property. Additionally, we hope to have Adeline assays out in the near future and thank our shareholders for their support and patience. With a strong treasury of over $4.5 million, and a dedicated exploration team with a track record of success, we remain excited and committed to diligent exploration in what we believe to be a Tier 1 jurisdiction.”

Figure 2. Plan map of 2023 hole locations and known mineralization.

Figure 3. Core photo of high-grade mineralization in hole SP-23-085 from 208.97m to 209.29m

Figure 4. Core photo of high-grade mineralization in hole SP-23-084 from 279.9m to 280.15m

Table 1. Reported assay intervals from 2023 Sail Pond drilling.

| Drillhole | From (m) | To (m) | Length (m) | AgEq (g/t) | Ag (g/t) | Cu (%) | Pb (%) | Zn (%) | Sb (%) |

| SP-23-079 | 98.08 | 98.43 | 0.35 | 209.7 | 79 | 0.094 | 3.89 | 0.014 | 0.042 |

| SP-23-080 | 236 | 236.25 | 0.25 | 110.2 | 62 | 0.25 | 0.17 | 0.18 | 0.06 |

| SP-23-081 | No Significant Results | ||||||||

| SP-23-082 | Hole stopped due to hole alignment issue | ||||||||

| SP-23-082A | Hole stopped due to fault zone | ||||||||

| SP-23-083 | No Significant Results | ||||||||

| SP-23-084 | 278 | 280.15 | 2.15 | 93.6 | 40 | 0.16 | 0.22 | 0.70 | 0.038 |

| inc | 279.9 | 280.15 | 0.25 | 718.3 | 303 | 1.26 | 1.54 | 5.59 | 0.28 |

| and | 287.7 | 288 | 0.3 | 411.4 | 205 | 0.73 | 2.74 | 0.39 | 0.20 |

| SP-23-085 | 208 | 210.35 | 2.35 | 265 | 147 | 0.71 | 0.17 | 0.14 | 0.18 |

| inc | 208.97 | 209.29 | 0.32 | 1665.3 | 932 | 4.51 | 0.93 | 0.76 | 1.12 |

| and | 277.45 | 305.45 | 28 | 28.1 | 8.5 | 0.037 | 0.12 | 0.27 | 0.019 |

| inc | 279.92 | 280.17 | 0.25 | 259.4 | 105 | 0.42 | 0.82 | 1.83 | 0.14 |

| inc | 288.25 | 288.6 | 0.35 | 201.7 | 2 | 0.019 | 0.06 | 5.81 | 0.016 |

| inc | 299 | 299.25 | 0.25 | 145.6 | 10 | 0.044 | 2.88 | 0.36 | 0.198 |

| inc | 300.55 | 301 | 0.45 | 208.9 | 110 | 0.39 | 0.31 | 0.94 | 0.10 |

- See Figure 2 and Table 2 for drillhole locations.

- All reported depths and intervals are drill hole depths and intervals unless otherwise noted, and do not represent true thicknesses, which have yet to be determined.

Table 2. Reported 2023 Sail Pond hole locations and directions.

| Hole ID | Easting | Northing | Elevation (m) | Azimuth | Dip | Final Depth (m) |

| SP-23-079 | 575543 | 5653059 | 63.4 | 290 | -65 | 343 |

| SP-23-080 | 575653 | 5653012 | 75 | 290 | -65 | 493 |

| SP-23-081 | 576255 | 5652556 | 106 | 280 | -45 | 208 |

| SP-23-082 | 575502 | 5653080 | 66.18 | 290 | -45 | 54 |

| SP-23-082A | 575502 | 5653080 | 66.18 | 295 | -45 | 108 |

| SP-23-083 | 575376 | 5652667 | 78 | 295 | -45 | 178 |

| SP-23-084 | 575741 | 5653185 | 73 | 290 | -45 | 352 |

| SP-23-085 | 575741 | 5653185 | 73 | 290 | -55 | 322 |

Silver Equivalent Calculation

Silver equivalent (Ag Eq) values were calculated using the following formula: ((Ag_oz*$USAg_price/oz)+(Cu_lb*$USCu_price/lb)+(Pb_lb*$USPb price/lb)+(Sb b*$USSb_price/lb)+(Zn_lb*$USZn_price/lb))/$USAg_price/oz.

Silver equivalent grade calculations are based on the current spot metal prices and are provided for comparative purposes only. This approach reflects the polymetallic nature of the mineralization. Metal spot prices as at the close of the London Metals Exchange November 23, 2023 were applied and include: Ag – $US 22.96/oz; Cu – $US3.57/lb; Zn – $US1.11/lb; Pb – $US 0.97/lb. The Sb – $US 6.01/lb price applied was sourced from Argus Media, a recognized provider of energy and commodity price benchmarks. The Company has yet to complete metallurgical test work to confirm individual metal recoveries. At this stage there is no reason to expect different recoveries for each metal or way to apply unique recoveries, and thus a constant recovery of 100% for each metal has been applied. Metallurgical tests will be required to establish recovery levels for each element reported.

Quality Assurance/Quality Control – Sampling Procedures

All drill holes are diamond core with NQ diameter. Drill core is delivered by truck to the Sterling Metals secure core logging and sampling facility in Roddickton, NL. All core is photographed, logged and sampled by the Sterling Metals exploration team. Drill core was halved by sawing with diamond saw blade at the Sterling core facility and half-core samples were placed in pre-labelled clear sample bags with a unique sample ID tag, sealed with a zip tie, and then placed into rice bags sealed with security tags and securely and securely stored at the facility until being delivered to SGS Grand Falls site by commercial transport.

Analytical services were provided by SGS Canada Inc., which is an independent, CALA-accredited analytical services firm registered to ISO 17025 standard. Samples were crushed to 75% passing 2mm mesh, split to 250g, and pulverized to 85% passing 75 micron mesh. Multi-element analyses, including base metals, were conducted on pulverized material using the sodium-peroxide fusion ICP AES finish method for 29 elements. Laboratory over-limits analysis methods were applied as required. In addition, an aqua-regia digest with AES finish for 1-300 ppm silver, over limits analyzed with fire assay and gravimetric finish. A systematic QAQC protocol was employed that includes systematic insertion in the sample stream of certified reference materials and blank samples, plus analysis of duplicate core and pulp splits.

Qualified Person

Jeremy Niemi, P.Geo., Senior Vice President, Exploration and Evaluation for Sterling Metals has reviewed and approved the technical information presented herein.

About Sterling Metals

Sterling Metals (TSXV: SAG and OTCQB: SAGGF) is a mineral exploration company focused on large scale and high-grade Canadian exploration opportunities. The Company is advancing the Adeline Project in Labrador which covers an entire sediment-hosted copper belt, with demonstrated potential for important new copper discoveries with significant silver credits, and the Sail Pond Project in Newfoundland.

For more information, please contact:

Sterling Metals Corp.

Mathew Wilson, CEO and Director

Tel: (416) 643-3887

Email: [email protected]

Website: www.sterlingmetals.ca

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release contains certain “forward-looking information” within the meaning of applicable securities laws. Forward looking information is frequently characterized by words such as “plan”, “expect”, “project”, “intend”, “believe”, “anticipate”, “estimate”, “may”, “will”, “would”, “potential”, “proposed” and other similar words, or statements that certain events or conditions “may” or “will” occur. These statements are only predictions. Forward-looking information is based on the opinions and estimates of management at the date the information is provided, and is subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking information. For a description of the risks and uncertainties facing the Company and its business and affairs, readers should refer to the Company’s Management’s Discussion and Analysis. The Company undertakes no obligation to update forward-looking information if circumstances or management’s estimates or opinions should change, unless required by law. The reader is cautioned not to place undue reliance on forward-looking information.