Sterling Metals Announces Results of 2022 Regional Drilling and Orion 3D Geophysical Survey at Sail Pond

May 8, 2023

May 8, 2023 – Toronto, Ontario – Sterling Metals Corp. (TSXV: SAG) (OTCQB: SAGGF) (“Sterling Metals” or the “Company”) is pleased to announce the completion of the Deep Orion 3D geophysical survey and report the balance of results from its 2022 drilling on the Sail Pond Silver and Base Metal Project in the Great Northern Peninsula of Newfoundland. Drilling results are from the regional exploration program focused on the North and Central Zones.

Highlights:

Orion Survey

- Four new exploration targets discovered.

- Favorable geology mapped to depth of 2 kilometres.

- Strong anomaly beneath newly discovered Heimdall North Zone and SP-22-064.

- Surveyed 1.5 km of the 14 km trend as a test before large-scale application.

- Permits for summer drilling submitted.

- Plans to test identified anomalies in coming months.

- Airborne survey planned to scan entire property based on drill results.

2022 Regional Exploration Results

- Intercepted wide zones of brecciated dolostones showing variably developed polymetallic mineralization along ~4 km of strike.

- Discovery of a new mineralized system at depth, the Central Ridge Zone, which has the potential to be another pearl along the ~12 km trend, marking the fourth area of mineralization discovered on the property in two years.

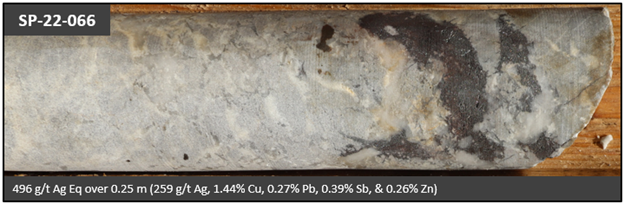

- Sail Pond North revealed new pockets of mineralization, including the highest grade to date in the area at 18.55 m downhole in SP-22-066 at 496 g/t AgEq over 0.25 m (259 g/t Ag, 1.44% Cu, 0.27% Pb, 0.26% Zn, 0.39% Sb).

- Intervals intersected at Sail Pond North appear to be the upper portions of a larger mineralized system, exhibiting similar host geology and mineralization to the top of the Heimdall Zone.

- Better understanding of the orientation of the structures will provide better targeting in future drill programs.

Jeremy Niemi, Senior Vice President of Exploration and Evaluation stated, “During our 2022 drilling campaign at Sail Pond, the discovery of new zones of high-grade silver-copper mineralization was a cause for great satisfaction among our team. Close examination of the core revealed that our drilling may have intersected the edges of a more extensive mineralization system. This encouraged our team to deploy the best-in-class high resolution 3D geophysical survey to guide our next exploration steps towards potentially larger zones. It is fantastic that four new targets have emerged where we would expect to see larger bodies of mineralization. The targets fit very well with our regional geological interpretation; we eagerly anticipate the opportunity to drill them in the coming months. This is a very exciting time for the Sail Pond Project and the Sterling Metals team.”

2023 Orion Survey

The Deep Orion 3D Swath DCIP and MT Survey employed state-of-the-art 3D ground geophysical techniques on a priority area which includes the Heimdall and Heimdall North Zones. The survey was designed with 200 m spaced lines and readings between lines to generate a 3D interpretation of key structural controls on mineralization and to identify potential high-grade feeder zones as exploration targets. The survey utilized 3 km long lines for deep viewing measuring IP (chargeability) to locate potential sulphide mineralization bodies to 500 m depth, and MT (resistivity) to map favorable host geology to 2 km depth.

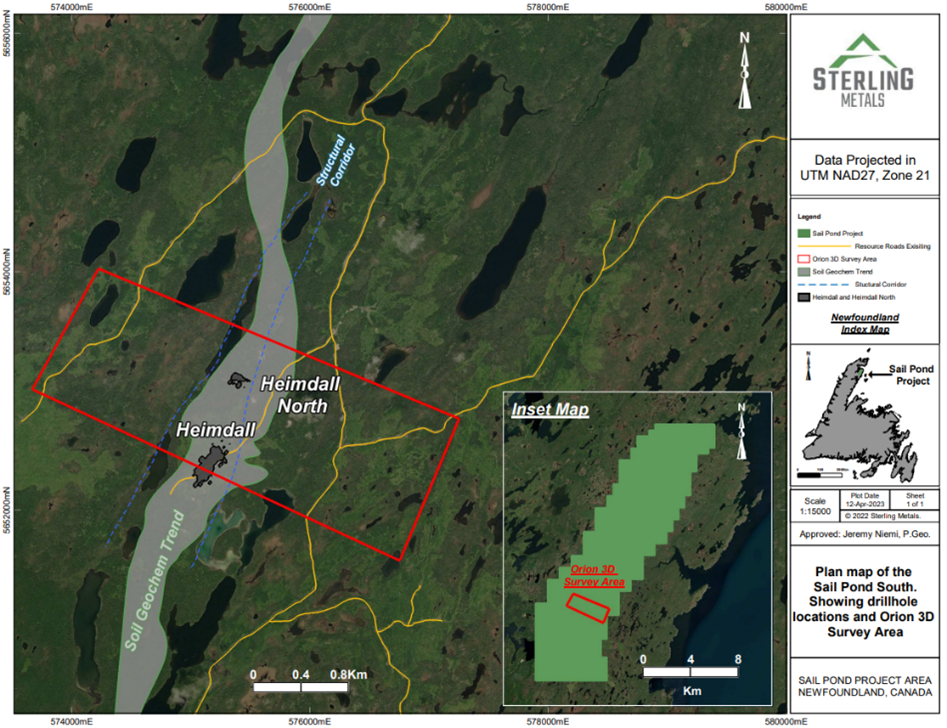

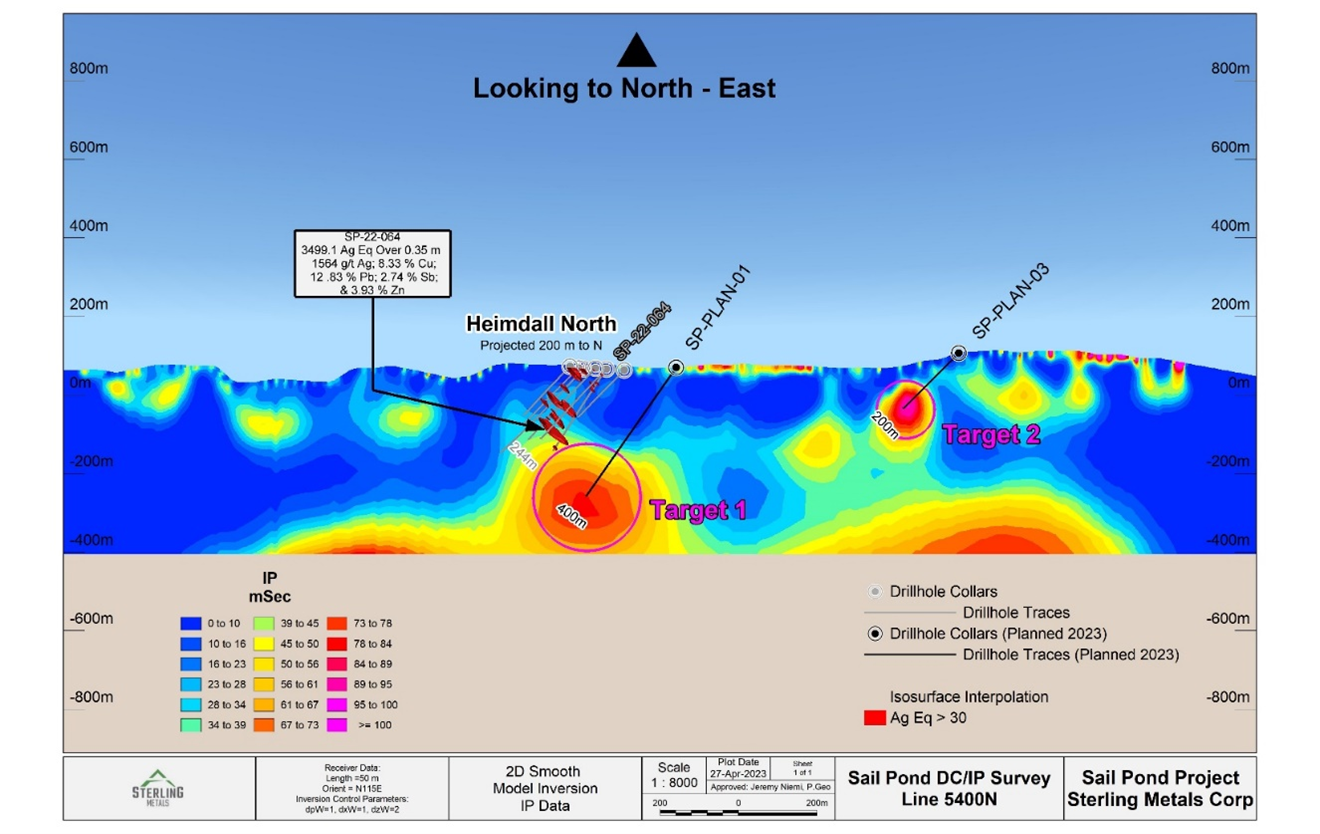

The deep-looking Orion survey uncovered several new IP anomalies and successfully mapped the favorable anticline geology of the host dolostone unit to 2 km depth. Cross-cutting north-east trending structures, potentially mineral-bearing, were also identified. In total 1.5 km of the 14 km trend at Sail Pond was surveyed as a test before covering larger sections of the property. The results of this survey have isolated four new exploration targets, including a strong IP anomaly coincident with a resistivity high discovered beneath the new Heimdall North Zone and SP-22-064. Permits for summer drilling have been submitted, and plans are underway to test these anomalies in the coming months. Additionally, an airborne geophysics survey is planned to scan the entire property based on drill results. As shown in Figure 1, the final footprint of the Orion survey was focused on the most prospective area surrounding the Heimdall and Heimdall North Zones. Two of the new targets are in proximity to the Heimdall North Zone and displayed in Figure 2.

Figure 1. Final Orion 3D Survey Area at the Sail Pond Project

Figure 2. Cross section from Orion 3D survey at Heimdall North showing two of four new targets.

Mathew Wilson, CEO of Sterling Metals stated, “Typically, numerous mining cycles and efforts from many companies working on a new discovery are required to reach the stage that has been achieved at Sail Pond. It is with great excitement that we anticipate to drill these highly encouraging anomalies which exist below the 1km footprint of Heimdall and Heimdall North. With nearly $8 million in the bank, the start of the Sail Pond drill program marks the initial phase of shareholder value creation, as we intend to undertake drilling activities at both Sail Pond and Adeline this summer.”

2022 Regional Exploration Results

Sterling’s 2022 drilling program successfully completed 34 new holes for over 7,500 m of drilling at new targets and the Heimdall Zone. Highlights of the program are the expanded mineralization at Heimdall and newly identified mineralized zone 500 m to the north. The gap between Heimdall and the new zone to the north is virtually wide open and considered very prospective, especially due to the presence of new Orion 3D targets. Targeting for the 2022 program incorporated a detailed structural interpretation by SRK and a comprehensive study by Goldspot which utilized an exploration targeting matrix of 6 geological and geophysical factors which included: presence of silver and copper mineralization at surface, prominent regional north-east trending structures in proximity (as interpreted by SRK), a warp in the argillite contact, distinct breaks in high chargeability anomalies and coincident highs in resistivity.

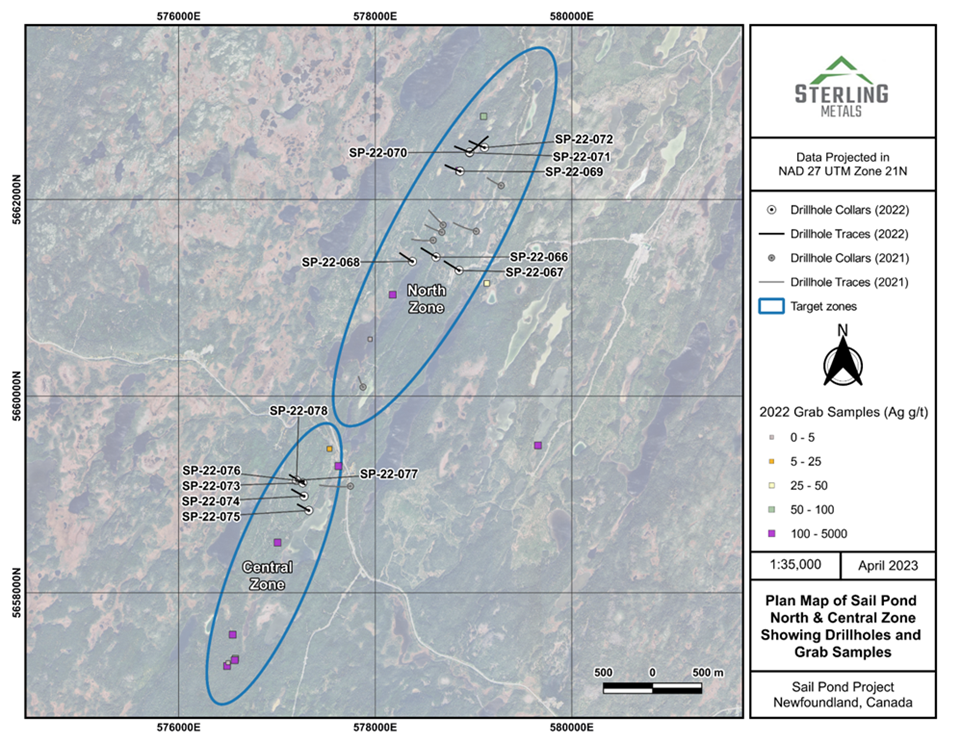

Today’s results come from drillholes testing regional targets along the ~14 km of prospective strike length and focused grab sampling from regional target generation and project enhancement. Figure 3 shows a plan map of drillhole and grab sample locations. Prospecting and geological mapping was focused on several highly prospective targets that were identified using our updated exploration targeting matrix.

Figure 3: Plan map showing drill hole locations and grab samples at the Sail Pond North and Central Ridge Zones

Across the Sail Pond Project structural complexity is associated with the localization of polymetallic mineralization. The drilling in the Sail Pond North and Central Zone concentrated on locations with similar structural complexities where obliquely converging faults/lineaments intersect the main foliation in the area, often associated with anomalous samples. The regional targets were successful in intercepting wide zones of brecciated dolostones showing variably developed polymetallic mineralization along ~4 km of strike.

The regional target generation and drilling resulted in the discovery of a new mineralized system at depth, the Central Ridge Zone (Central Ridge), which has the potential to be another pearl along the ~12 km trend. Occurring in close proximity to a structural kink or jog, the Central Ridge is characterized by a wide zone of mineralized brecciated dolostone with clots of sulphides and sulfosalts. The thick veins and massive portions of the system are yet to be discovered, and the area is wide open in all directions. This marks the fourth area of mineralization discovered on the property in two years. In addition, Sail Pond North continued to reveal new pockets of mineralization, including the highest grade to date in the area at 18.55 m downhole in SP-22-066. The intervals intersected appear to be the upper portions of a larger mineralized system, exhibiting similar host geology and mineralization to the top of the Heimdall Zone. An example of core from the North and Central Zone is shown in Figure 4 & 5.

The mineralization at Sail Pond, especially the high-grade veins, is structurally controlled and understanding the orientation of the structures is vital to expanding zones and identifying potential new zones along preferred structural trends. The Company has completed an extensive down hole optical televiewer study to measure the orientation of high-grade veins and other structural features in important drill holes across the property. This data and the enhanced geological model will play a significant role in the targeting for the next drill programs.

The primary host rock for mineralization identified is a thick sequence of highly altered and often brecciated dolostone of the Cambro-Ordovician Saint George Group. Mineralization encountered to date typically consists of tetrahedrite-tennantite, chalcocite, sphalerite, galena, pyrite, and potentially additional sulfosalt minerals. Quartz veining and associated mineralization are ubiquitous throughout the dolostone unit, but included metallic mineralization is best developed in areas of combined brecciation and veining. The structural evolution and metallogenic sequencing are very complex, and mineralization has been identified in association with a multitude of structural events.

Figure 4: Dolostone-hosted breccia-style sulfide mineralization in hole SP-22-066 at 18.63 – 18.71 m

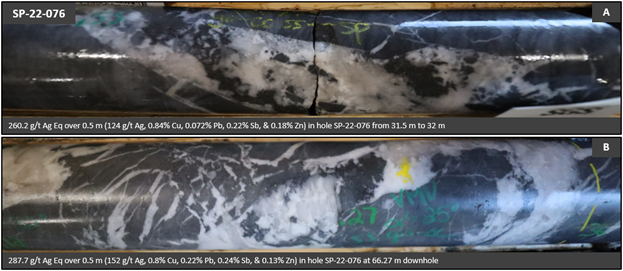

Figure 5: Quartz-carbonate vein-hosted disseminated to semi-massive mineralization within host brecciated dolostone in hole SP-22-076

Table 1. Reported assay intervals from Sail Pond 2022 drilling.

| Drillhole | Zone | From (m) | To (m) | Length (m)* | AgEq (g/t) | Ag (g/t) | Cu (%) | Pb (%) | Zn (%) | Sb (%) |

| SP-22-066 | North | 18.55 | 18.8 | 0.25 | 496 | 259 | 1.44 | 0.27 | 0.26 | 0.39 |

| and | 25.5 | 25.75 | 0.25 | 101 | 48 | 0.32 | 0.12 | 0.067 | 0.078 | |

| SP-22-067 | North | No Significant Results | ||||||||

| SP-22-068 | North | 3.5 | 4.15 | 0.65 | 340.3 | 181 | 0.99 | 0.31 | 0.19 | 0.22 |

| SP-22-069 | North | 36 | 37 | 1 | 119 | 60 | 0.26 | 0.32 | 0.35 | 0.061 |

| inc | 36 | 36.5 | 0.5 | 161.3 | 75 | 0.32 | 0.55 | 0.66 | 0.086 | |

| and | 122 | 122.25 | 0.25 | 115.7 | 69 | 0.27 | 0.096 | 0.061 | 0.076 | |

| SP-22-070 | North | 16 | 22.25 | 6.25 | 24.2 | 13.5 | 0.052 | 0.051 | 0.042 | 0.013 |

| inc | 16 | 16.27 | 0.27 | 96 | 43 | 0.16 | 0.22 | 0.67 | 0.041 | |

| and | 99.06 | 99.89 | 0.83 | 96.4 | 49 | 0.16 | 0.15 | 0.52 | 0.045 | |

| and | 123.5 | 124 | 0.5 | 130 | 65 | 0.22 | 0.24 | 0.70 | 0.067 | |

| SP-22-071 | North | 65.75 | 66.25 | 0.5 | 284.1 | 124 | 0.50 | 1.26 | 1.35 | 0.15 |

| inc | 65.75 | 66 | 0.25 | 322.4 | 150 | 0.62 | 1.62 | 0.83 | 0.202 | |

| and | 107.14 | 107.6 | 0.46 | 79.1 | 41 | 0.15 | 0.24 | 0.26 | 0.039 | |

| SP-22-072 | North | No Significant Results | ||||||||

| SP-22-073 | Central | 46 | 46.5 | 0.5 | 108.2 | 60 | 0.27 | 0.078 | 0.071 | 0.084 |

| 56.35 | 56.6 | 0.25 | 183.5 | 95 | 0.53 | 0.035 | 0.084 | 0.16 | ||

| SP-22-074 | Central | 95.2 | 95.9 | 0.7 | 86.5 | 40 | 0.24 | 0.09 | 0.196 | 0.07 |

| and | 121.1 | 121.4 | 0.3 | 97 | 52 | 0.27 | 0.045 | 0.05 | 0.078 | |

| and | 123.25 | 123.55 | 0.3 | 150 | 65 | 0.36 | 0.51 | 0.48 | 0.093 | |

| SP-22-075 | Central | No Significant Results | ||||||||

| SP-22-076 | Central | 31.5 | 34 | 2.5 | 84.7 | 38.8 | 0.22 | 0.25 | 0.15 | 0.059 |

| inc | 31.5 | 32 | 0.5 | 260.2 | 124 | 0.84 | 0.072 | 0.18 | 0.22 | |

| and | 57 | 73 | 16 | 24.1 | 12.3 | 0.063 | 0.032 | 0.029 | 0.018 | |

| inc | 62.5 | 63 | 0.5 | 110.2 | 59 | 0.29 | 0.14 | 0.058 | 0.085 | |

| inc | 66 | 66.5 | 0.5 | 287.7 | 152 | 0.80 | 0.22 | 0.13 | 0.24 | |

| inc | 72 | 72.25 | 0.25 | 202 | 106 | 0.56 | 0.27 | 0.12 | 0.14 | |

| and | 127 | 128 | 1 | 193 | 42 | 0.19 | 0.78 | 3.07 | 0.0092 | |

| SP-22-077 | Central | 108.9 | 109.15 | 0.25 | 152.2 | 72 | 0.36 | 0.25 | 0.56 | 0.089 |

| SP-22-078 | Central | 40.35 | 41.85 | 1.5 | 94.7 | 48.3 | 0.18 | 0.53 | 0.13 | 0.05 |

| inc | 40.81 | 41.18 | 0.37 | 263.8 | 136 | 0.47 | 1.92 | 0.082 | 0.14 | |

Table 2. Reported Sail Pond drillhole locations and orientations.

| HoleID | Easting | Northing | Elevation (m) | Azimuth | Dip | Final Depth (m) | Target |

| SP-22-066 | 578619 | 5661414 | 53.51 | 300 | -45 | 250 | North Zone |

| SP-22-067 | 578854 | 5661279 | 67 | 300 | -45 | 241 | North Zone |

| SP-22-068 | 578379 | 5661369 | 49.68 | 300 | -45 | 217 | North Zone |

| SP-22-069 | 578864 | 5662287 | 74.32 | 290 | -45 | 233 | North Zone |

| SP-22-070 | 578961 | 5662481 | 77 | 290 | -45 | 232 | North Zone |

| SP-22-071 | 578960 | 5662476 | 77 | 50 | -60 | 523 | North Zone |

| SP-22-072 | 579112 | 5662528 | 74 | 290 | -50 | 251 | North Zone |

| SP-22-073 | 577263 | 5659118 | 70 | 300 | -45 | 215 | Central Zone |

| SP-22-074 | 577276 | 5658982 | 65 | 300 | -45 | 197 | Central Zone |

| SP-22-075 | 577324 | 5658837 | 50 | 300 | -45 | 179 | Central Zone |

| SP-22-076 | 577202 | 5659144 | 76 | 120 | -45 | 133 | Central Zone |

| SP-22-077 | 577202 | 5659144 | 76 | 120 | -54 | 131 | Central Zone |

| SP-22-078 | 577202 | 5659144 | 76 | 100 | -50 | 121 | Central Zone |

Option Grant

In addition, the Company announces that it has granted an aggregate of 6,280,000 options to purchase common shares of the Company exercisable at a price of $0.15 per common share for a period of two (2) years to directors, officers, and consultants of the Company. The common shares issuable upon exercise of the options are subject to a four month hold period from the original date of grant.

Silver Equivalent Calculation

Silver equivalent (Ag Eq) values were calculated using the following formula:

[(Ag_oz*$USAg_price/oz)+(Cu_lb*$USCu_price/lb)+(Pb_lb*$USPb price/lb)+(Sb lb*$USSb_price/lb)+(Zn_lb*$USZn_price/lb)]/$USAg_price/oz.

Silver equivalent grade calculations are based on the current spot metal prices and are provided for comparative purposes only. This approach reflects the polymetallic nature of the mineralization.

Recovery factors of 100% have been assumed for all metals. Metallurgical tests will be required to establish recovery levels for each element reported. Metal spot prices as at the close of the London Metals Exchange April 6th, 2023 were applied and include: Ag – $US 24.90/oz; Cu – $US4.02/lb; Zn – $US1.28/lb; Pb – $US 0.96/lb. The Sb – $US 5.74/lb price applied was sourced from Argus Media, a recognized provider of energy and commodity price benchmarks.

Qualified Person

Jeremy Niemi, P.Geo., Senior Vice President of Exploration and Evaluation for Sterling Metals has reviewed and approved the technical information presented herein.

Laboratory Technical Note

Analytical services were provided by SGS Canada Inc., which is an independent, CALA-accredited analytical services firm registered to ISO 17025 standard. Drill core was halved by sawing at the Sterling core facility and half-core samples were securely stored at the facility until being delivered to SGS Grand Falls site by commercial transport. Samples were crushed to 75% passing 2 mm, split to 250g, and pulverized to 85% passing 75 microns. Multi-element analyses, including base metals, were conducted on pulverized material using the ICP-AES method for 34 elements. Laboratory over-limits analysis methods were applied as required. A systematic QAQC protocol was employed that includes systematic insertion in the sample stream of certified reference materials and blank samples, plus analysis of duplicate pulp splits and core splits.

About Sterling Metals

Sterling Metals (TSXV: SAG and OTCQB: SAGGF) is a mineral exploration company focused on Canadian exploration opportunities. The Company is currently advancing its 100% owned Sail Pond Project located in the Great Northern Peninsula of Newfoundland and recently acquired the Adeline Project in Labrador. The 13,500 ha Sail Pond Project is a brand-new discovery, first discovered in 2016 with no drilling prior and consists of high grade, silver, copper, lead and zinc associated with quartz-carbonate veining, brecciated dolostone, and 100% sulfosalt veining. The 29,700 ha Adeline Project is a mid-stage exploration project covering an entire sediment-hosted copper belt, with demonstrated potential for important new copper discoveries with significant silver credits. Both projects are easily accessible by road with nearby services and a 30-min flight from one another.

For more information, please contact:

Sterling Metals Corp.

Mathew Wilson, President & CEO

Tel: (416) 643-3887

Email: [email protected]

Website: www.sterlingmetals.ca

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release contains certain “forward-looking information” within the meaning of applicable securities laws. Forward looking information is frequently characterized by words such as “plan”, “expect”, “project”, “intend”, “believe”, “anticipate”, “estimate”, “may”, “will”, “would”, “potential”, “proposed” and other similar words, or statements that certain events or conditions “may” or “will” occur. These statements are only predictions. Forward-looking information is based on the opinions and estimates of management at the date the information is provided, and is subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking information. For a description of the risks and uncertainties facing the Company and its business and affairs, readers should refer to the Company’s Management’s Discussion and Analysis. The Company undertakes no obligation to update forward-looking information if circumstances or management’s estimates or opinions should change, unless required by law. The reader is cautioned not to place undue reliance on forward-looking information.