Sterling Metals Expands its Critical Metal Portfolio within Newfoundland and Labrador

March 6, 2023

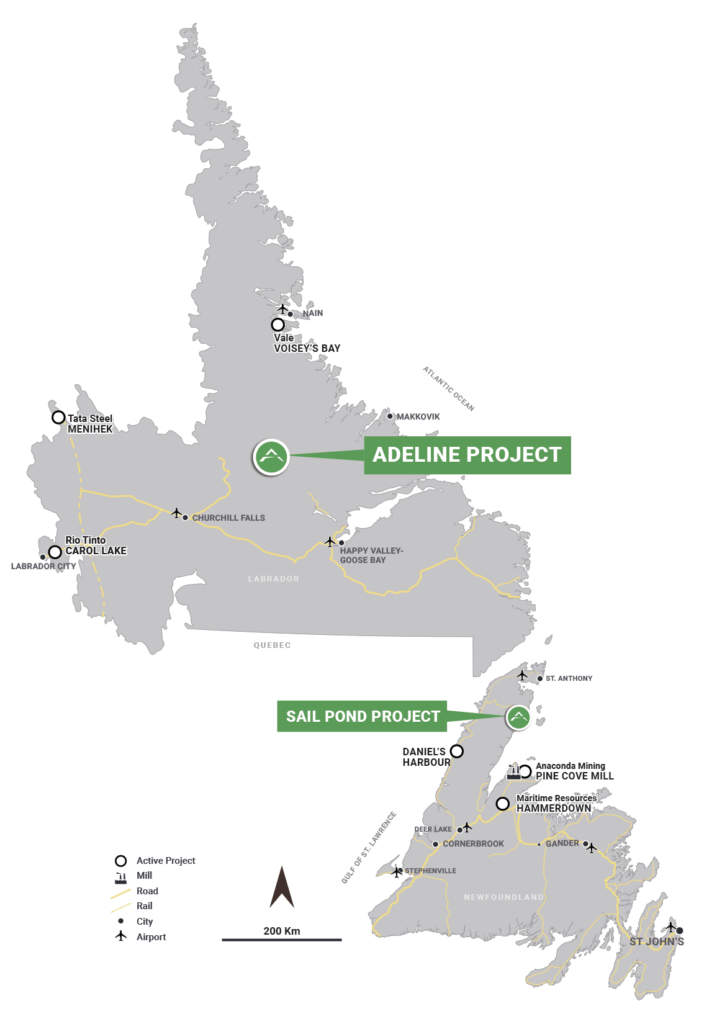

March 6, 2023 – Toronto, Ontario – Sterling Metals Corp. (TSXV: SAG and OTCQB: SAGGF) (“Sterling Metals”, “SAG” or the “Company”) is pleased to announce that it has entered into an option agreement (the “Agreement”) dated March 6, 2023, with Chesterfield Resources Plc. (LSE: CHF, “Chesterfield”) and its wholly owned subsidiary Chesterfield (Canada) Inc. (“Chesterfield Canada”) and together with Chesterfield (collectively, the “Optionors”) pursuant to which SAG has been granted the exclusive option to acquire 100% of the Adeline Copper-Silver Project (“Adeline” or the “Project”) in Labrador, Canada (Figure 1).

Highlights of the Adeline Copper-Silver Project:

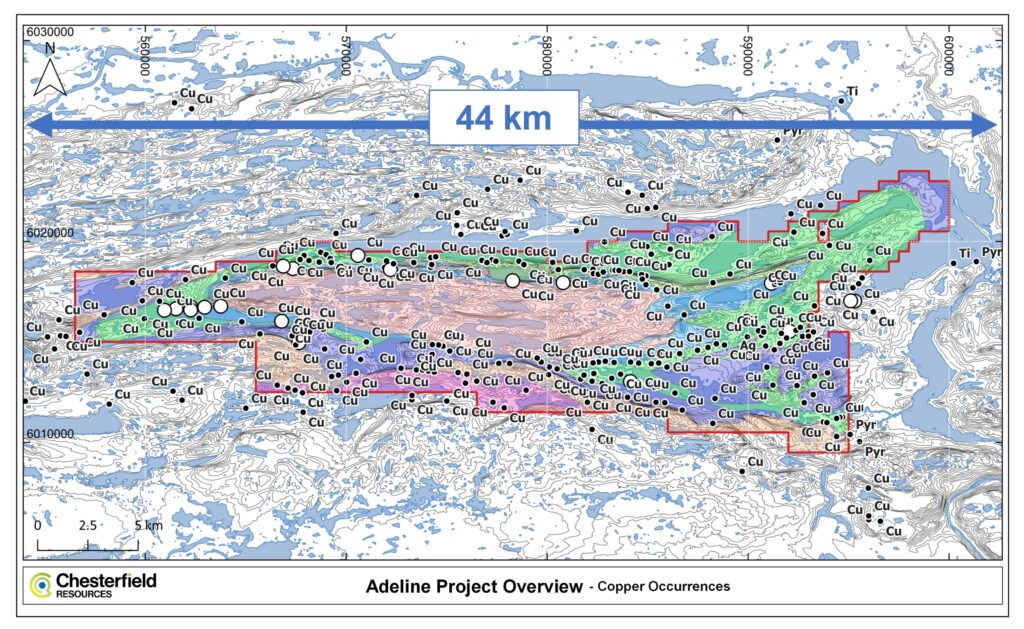

- 297 km2 district-scale land position prospective for sediment-hosted high-grade copper and silver mineralization with 44 km of strike length of the target stratigraphic horizon (Adeline Island Formation);

- Strong geological comparisons with preferred epigenetic sediment-hosted copper deposits such as Udokan (estimated reserves of 1.2 Bt at 2% Cu;

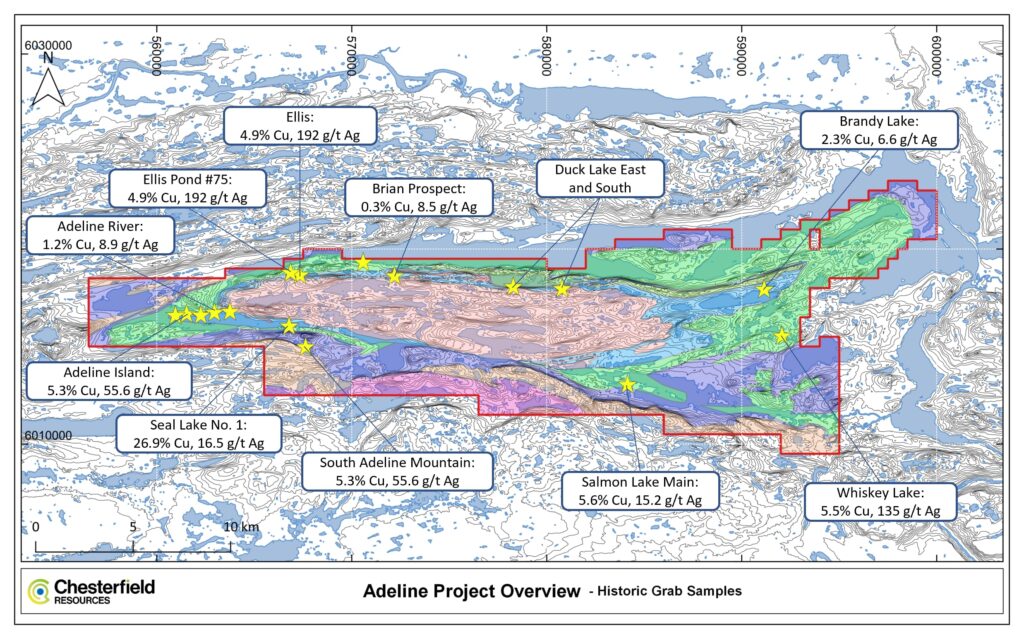

- Robust early-stage exploration database including Mag/IP/Resistivity and over 250 copper samples assaying as high as 26.9% Cu (see Figure 2);

- Pipeline of exploration targets at different stages of development including two drill-ready targets at two key prospects, one of which has returned an encouraging intercept of 1.76% Cu and 58.2 g/t Ag over 7.9 m on the edge of a large chargeability anomaly (2011, Playfair hole SL-11-10); and

- Project located close to road, rail, and power infrastructure and within 500 km of the Sail Pond project allowing for strong economies of scale for exploration.

Watch CEO Mathew Wilson discuss today’s announcement here.

Mathew Wilson, CEO of Sterling Metals commented, “Our focus is to establish the foundation for a successful Canadian mining company in one of Canada’s most favourable yet underexplored districts. Canada was once a global leader in copper production but has since fallen off the map due to a lack of new high grade greenfield discoveries. As the country looks to enhance its domestic security of supply of critical metals, new large-scale high-grade discoveries in metals such as copper, silver, and to some degree zinc and antimony, sticks out as a key missing piece.

With the option of Adeline, we will now have two assets that possess these attributes within a 30-minute flight of one other. We eagerly await the initial results of our Orion survey at Sail Pond which looks to show the true size potential at depth of the polymetallic, silver and copper rich system.

I want to also take this time to welcome Chesterfield and its shareholders to Sterling. I am confident that by the end of 2023, we will all have come a long way towards recognizing the true potential of both of these exciting assets.”

Dr. Neil O’Brien, Technical Advisor to Sterling Metals commented, “Adeline is an excellent entry point to a mid-stage exploration project covering an entire sediment-hosted copper belt and will be an exceptional complement to Sterling’s portfolio. Previous work has clearly demonstrated its potential for important new copper discoveries with significant silver credits. There are distinct similarities to many of the world’s great sediment-hosted copper deposits and belts including very rich copper ore mineralogy, efficient metal traps needed to form economic copper-silver deposits, and km-scale strike extents of prospective geology with hundreds of copper showings that allow for multiple camp-scale discoveries. With a rich exploration and research database, we look forward to leveraging our deep understanding of the project to develop smart drill targets in a cost-effective and timely manner.”

Figure 1: Adeline Project in Labrador, Canada

Terms of the Option

Sterling has the option to acquire a 100% undivided legal and beneficial interest in the Project by making the following cash payments and issuing the following common shares (each, a “Common Share”) in the capital of Company:

a) making an aggregate of $800,000 in cash payments (collectively, the “Cash Payments”) to Chesterfield as follows:

i. $100,000 upon signing of the Agreement;

ii. $300,000 on the earlier of the Closing Date and the date that is 45 days after the signing of the Agreement; and

iii. $400,000 on or before November 30, 2024;

b) the issuance of an aggregate of 9,000,000 Common Shares, to the Optionors as follows:

i. 4,500,000 Common Shares on the Closing Date;

ii. 4,500,000 Common Shares on or before November 30, 2024

Comprised of roughly 30,000 hectares and a 44 km strike of copper-silver-rich terrain, the Adeline project covers the youngest middle Mesoproterozoic volcano-sedimentary sequences, known as the Seal Lake Group. The Seal Lake Group consists of supracrustal argillaceous and arenaceous sedimentary rocks, intercalated with basalt flows and intruded by gabbro sills. The volcano-sedimentary rocks formed as a result of extensive continental sedimentation from the transition from subaerial to shallow-marine during a rift-related cycle of uplift and erosions.

Structurally, the Seal Lake Group rocks are in thrust contact with the Paleoproterozoic granitoids of the Trans-Labrador batholith to the south. Immense structural deformation related to the 1.3 to 1.0 Ga collisional development of the Rodinia supercontinent, resulted in stratigraphic repetition of the sequences and complexly folded the group into an east-trending, doubly plunging syncline that is 120 km long and 45 km wide. The southern limb of the syncline has been overturned and thrust northward during Grenville Orogeny deformation (ca. 1.0 Ga). The western side of the syncline exhibits more intense deformation with tighter folds than the eastern side (Altius, Seal Lake Copper Project Technical Report, 2015; T.S. van Nostrand, Geology of the Seal Lake area, 2010).

The Adeline Project sediment-hosted copper-silver mineralization formed in response to the same globally significant geological event, the Grenville Orogeny, which formed the giant copper deposits of the Keweenawan Copper Belt in Michigan and contributed to the formation of the significant copper deposits of the Zambian and Kalahari Copper Belts.

Mineralization

The sediment-hosted copper deposit class is attractive as it can yield orebodies that host large tonnages similar to porphyry copper deposits but with significantly higher grades, an example of which is KGHM’s Lubin Mine in Poland, the most significant mine in the Kupferschiefer copper district, in production since 1968 and hosting 2.6 billion tonnes of ore grading 2% copper. At Adeline, both the geological setting and the style of copper mineralization suggest a favourable environment for hosting sediment-hosted stratabound copper deposits.

Figure 2: Copper occurrences at the Adeline Project

Figure 3: Historic Grab Samples

Copper mineralization at Adeline is structurally controlled, and commonly associated with quartz +/- carbonate veins in a manner similar to that at Udokan, Russia, and is greatly influenced by the oxidation state of the various rock types (oxidized vs reduced) (Altius, Seal Lake Copper Project Technical Report, 2015). The mineralization occurs in two distinct styles:

- As bedding, foliation and cleavage parallel, fine-grained disseminated masses of chalcocite ± bornite ± chalcopyrite that grade into stratiform lenses of similar composition in the grey, green to black shales. Also present are chalcocite ± bornite ± chalcopyrite stringers and quartz-carbonate veins in diabase and basalt, as well as in the grey, green to black shales, arenite and phyllite (reduced “grey beds”). Mainly present in the Adeline Island Formation.

- Native copper-bearing quartz-carbonate veins within the red slate and/or strongly hematized basalt units of the Salmon Lake, Whiskey Lake and Wuschusk Lake formations.

Infrastructure and Jurisdiction

This Project maintains many advantages in the event of future development. Newfoundland and Labrador remain a top 10 jurisdiction for mining as pre the Fraser Institute. The Project is easily accessible by helicopter from Goose Bay. The Trans-Labrador highway is approximately 112 km away, a hydro access road is 61 km away, and the 5,428 MW Churchill Falls power station is 180 km away.

Qualified Person

Jeremy Niemi, P.Geo., Director of Exploration for Sterling Metals has reviewed and approved the technical information presented herein.

About Sterling Metals

Sterling Metals (TSXV: SAG and OTCQB: SAGGF) is a mineral exploration company focused on Canadian exploration opportunities. The Company is currently advancing its 100% owned Sail Pond Project located in the Great Northern Peninsula of Newfoundland. The Sail Pond Project consists of high grade, silver, copper, lead and zinc associated with quartz-carbonate veining, brecciated dolostone, and 100% sulfosalt veining. The project is a brand-new discovery, first discovered in 2016 with no drilling prior to 2021. The project area covers 13,500 ha and is easily accessible by road with nearby services and an airport.

For more information, please contact:

Sterling Metals Corp.

Mathew Wilson, President & CEO

Tel: (416) 643-3887

Email: [email protected]

Website: www.sterlingmetals.ca

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release contains certain “forward-looking information” within the meaning of applicable securities laws. Forward looking information is frequently characterized by words such as “plan”, “expect”, “project”, “intend”, “believe”, “anticipate”, “estimate”, “may”, “will”, “would”, “potential”, “proposed” and other similar words, or statements that certain events or conditions “may” or “will” occur. These statements are only predictions. Forward-looking information is based on the opinions and estimates of management at the date the information is provided, and is subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking information. For a description of the risks and uncertainties facing the Company and its business and affairs, readers should refer to the Company’s Management’s Discussion and Analysis. The Company undertakes no obligation to update forward-looking information if circumstances or management’s estimates or opinions should change, unless required by law. The reader is cautioned not to place undue reliance on forward-looking information.